Author: Aurélien Pillet, Climate & Innovative Finance Lead, Globesight

In recent years, the global community has intensified its efforts to combat climate change, recognizing it as one of the most pressing challenges of our time. However, despite the almost doubling in annual climate finance over the past decade, finance flows need to multiply at least seven-fold to US$ 4.3 trillion by 2030, as highlighted by the Climate Policy Initiative (2022). Climate finance needs to be mobilized from the public and private sectors as well as from conventional and innovative sources. As nations and organizations strive to implement sustainable practices and reduce carbon emissions, innovative approaches to finance are emerging. One such approach gaining traction is Islamic climate finance, which merges the principles of Islamic finance with environmental stewardship.

Islamic finance operates on the principles of Shariah, or Islamic law, which prohibits unethical or exploitative practices and encourages social responsibility and economic justice. The core principles of Islamic finance include the prohibition of interest (riba), uncertainty (gharar), and investments in businesses that involve activities deemed harmful or forbidden in Islam, such as alcohol, gambling, and weapons. According to the Asian Development Bank and the Islamic Development Bank (2022), Islamic finance has grown significantly since its inception in the 1970s and is a US$ 3 trillion industry in over 80 countries, concentrated in well-established Islamic finance markets, notably in the Gulf (Qatar, Saudi Arabia, and UAE) and Asia (Indonesia and Malaysia).

In the context of climate change, Islamic finance offers a unique perspective that aligns with the principles of environmental conservation and sustainable development. Islamic climate finance encompasses various instruments and mechanisms designed to fund projects and initiatives that address climate change while adhering to Shariah principles. In Islamic finance generally, there has been increasing interest in Environmental, Social, and Governance considerations (ESG), as well as green and sustainable products.

One of the key instruments of Islamic climate finance is the green Sukuk, often referred to as Islamic green bonds. Green Sukuk are structured to generate returns to investors without violating Islamic principles. These bonds can be used to finance green projects such as renewable energy infrastructure, energy-efficient buildings, and sustainable transportation systems. By issuing Sukuk for climate-friendly projects, governments and corporations can raise capital while contributing to environmental sustainability.

In addition to green Sukuk, Islamic banks and financial institutions are increasingly offering green financing products that comply with Shariah principles, such as green investment funds that channel capital into sustainable businesses and initiatives.

Islamic microfinance is another aspect of Islamic climate finance that focuses on providing financial services to low-income individuals and communities, particularly in regions vulnerable to the impacts of climate change. By offering microfinance products that support climate adaptation and resilience-building efforts, Islamic microfinance institutions contribute to poverty alleviation and environmental sustainability simultaneously.

Furthermore, Islamic social finance mechanisms such as Zakat (obligatory almsgiving) and Waqf (endowment) can be leveraged to finance climate-related projects and initiatives. Zakat funds, collected from eligible individuals, can be directed toward environmental conservation projects, disaster relief efforts, and community resilience programs. Similarly, Waqf assets, dedicated to charitable purposes, can be used to establish sustainable infrastructure and support climate adaptation measures.

The principles of transparency, accountability, and risk-sharing inherent in Islamic finance can enhance the resilience and effectiveness of climate finance initiatives. By prioritizing ethical investments and promoting equitable resource distribution, Islamic climate finance can contribute to the achievement of global climate goals while upholding the values of social justice and economic inclusivity.

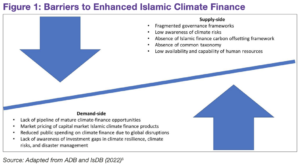

However, challenges remain in mainstreaming Islamic climate finance and scaling up its impact. According to the G20 (2023), Islamic climate finance constitutes less than 2% of global Islamic finance. These challenges include the lack of standardized frameworks for Shariah-compliant green finance, limited awareness and understanding of Islamic finance principles among stakeholders, and the need for greater collaboration between Islamic financial institutions, governments, and international organizations. (see Figure 1).

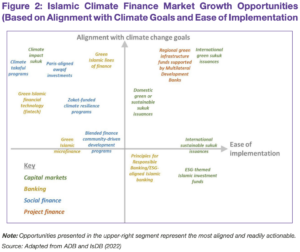

To overcome these challenges and unlock the full potential of Islamic climate finance, concerted efforts are required from policymakers, regulators, financial institutions, civil society organizations, and religious scholars. This may involve developing comprehensive guidelines and standards for Shariah-compliant green finance, enhancing capacity-building initiatives, and fostering partnerships to mobilize resources and expertise, as well as building dedicated project pipelines and proposing dedicated Islamic climate finance windows (e.g., in the Green Climate Fund) to support enhanced climate action. In addition, the 2023 G20 Policy Brief has identified opportunities for growth in the Islamic Climate Finance Market based on ease of implementation and alignment with climate goals. These include more accessible mechanisms such as International green sukuk issuances and regional green infrastructure funds supported by Multilateral Development Banks, as well as more climate-targeted goals such as climate takaful programs, green Islamic finance technology, and Paris-aligned awqaf investments. (See Figure 2)

The growth in international green sukuk issuances shows that Islamic climate finance represents a promising avenue for integrating faith-based values with environmental responsibility to address the urgent challenges of climate change and helping to bridge the climate finance gaps in the Middle East and North Africa (MENA), Sub Saharan Africa, and South Asia at pace, and at scale. By embracing the principles of ethical finance and social justice, as well as financial innovation, Islamic climate finance has the potential to catalyze climate finance pathways and contribute to a greener, more resilient, and equitable future for the regions.

read more