On Thursday, June 27, Globesight hosted the virtual roundtable “Innovative Climate Finance: Reforming Global Financial Architecture for a Sustainable Future” as part of the ‘Path to COP29’ event series and London Climate Action Week. The event, moderated by Globesight’s Climate & Innovative Finance Lead, Aurélien Pillet convened key stakeholders from international organizations, financial institutions, and philanthropic organizations, including esteemed guests: Saliem Fakir, Executive Director of African Climate Foundation; Dr. Mallé Fofana, Regional Director & Head of Programs – Africa at Global Green Growth Institute (GGGI); Satheesh Kumar Sundararajan, Lead Climate Finance Specialist at The World Bank Group; Guly Sabahi, Senior Advisor of Climate Finance at NDC Partnership, and; Lucia Fuselli, Founder of Climate Strategies & Energy Chair at WAPPP.

The discussion centered on innovative climate financing mechanisms and necessary reforms to mobilize resources effectively for climate mitigation and adaptation, particularly in the most vulnerable regions. The speakers collectively highlighted the critical need to address financing challenges hindering climate action in developing countries, especially with the upcoming COP29. The urgency for reforms in the international financial architecture and scaling up of climate finance was underscored. This common theme was echoed throughout the presentations, emphasizing the significant gap between current financial flows and what is required to meet the Paris Agreement goals.

In the discussion on key imperatives for climate finance, the urgent need to bridge the existing finance gap was stressed, noting that annual climate finance flows must increase significantly. The disparity between current financial flows and required investments, with particular emphasis on the insufficient public finance for adaptation and the need to scale up private sector investment, was highlighted. This sentiment was shared by all speakers, indicating a consensus on the necessity for increased and innovative financing mechanisms. The importance of aligning climate finance to the development needs of the countries, focusing on the real economy, was also emphasized.

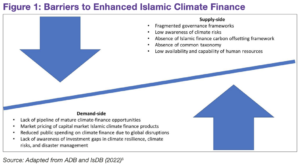

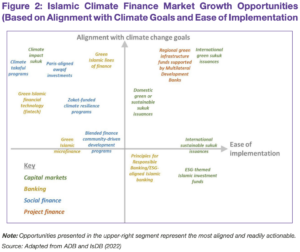

The challenges in the global financial architecture were addressed, noting high borrowing costs, debt sustainability issues, inadequate traditional financial instruments, inequitable distribution of funds, and administrative burdens. Each speaker provided their perspective on these issues, offering a comprehensive overview of the systemic problems that need to be tackled to improve climate finance flows. It was noted that broader partnerships beyond financiers, including all key stakeholders, are essential to support investment platforms and ensure long-term capacity building.

Recent developments in climate finance were discussed, highlighting key initiatives such as the Bridgetown Initiative, as well as high-level events like COP27, COP28, G20 meetings, World Bank-IMF Spring Meetings, AfDB and IsDB Annual Meetings, and recent discussions at Bonn SB60. The need for reform and the importance of innovative finance mechanisms in addressing the climate finance gap was emphasized. Despite numerous initiatives, it was noted that financial flows remain insufficient to meet the needs of the Global South, highlighting the importance of innovative climate finance to unlock private sector capital and minimize risks. The necessity of aligning large pools of capital beyond traditional climate finance to support development needs effectively was also stressed.

The importance of innovative financing mechanisms, strategic partnerships, and capacity building in achieving sustainable development and climate resilience in Africa was emphasized. Implementing NDCs in Africa is estimated to cost trillions of US dollars from 2020 to 2030, with significant needs identified in the agriculture, forestry, and other land use and water sectors. A unique approach to mobilizing green and climate finance has been developed, utilizing a value chain approach and providing technical assistance from policy development to investment mobilization and reporting. By the end of 2023, billions of US dollars in green and climate finance had been mobilized through instruments such as green bonds, thematic bonds, debt-for-nature swaps, and credit enhancement mechanisms. Various countries have been supported in developing their bond markets and implementing carbon pricing mechanisms and Article 6 policy approaches. The importance of having investment pipelines and bringing down the cost of capital in Africa to draw on domestic finance was underscored.

The need for reform in the global financial architecture to ensure a sustainable future was highlighted. The current global climate finance architecture was outlined, showcasing various funding sources and the immense climate finance needs of multiple trillions of US dollars per year by 2050. Opportunities within climate finance, including the role of climate funds as the ultimate de-riskers and finance aggregators, were emphasized. However, challenges such as a lack of firepower and insufficient capacity were also highlighted. Steps to address these challenges were suggested, including overhauling accreditation processes and focusing on regional programs to maximize private sector investments. Innovative climate finance instruments like debt-for-nature swaps and payments for ecosystem services were discussed, stressing the need for reform in the global financial architecture to mobilize necessary resources.

The critical need to increase climate finance to meet global warming targets and the role of international financial institutions in facilitating this were highlighted. The current inadequacy of climate finance levels was pointed out, emphasizing the importance of mobilizing private sector finance. An approach to increasing climate finance through various reforms and initiatives was detailed, including changing the mission to focus on global public goods, implementing climate-resilient debt clauses, and optimizing balance sheets. Several case studies illustrating efforts to mobilize private investments were provided, highlighting the importance of innovative financing structures and de-risking products.

An overview of efforts in climate investment planning and mobilization was provided, emphasizing the importance of a global coalition dedicated to ambitious climate action and sustainable development. An interactive tool developed to support the creation of ambitious, fair, and implementable NDCs for submission in 2025 was introduced. The need for a programmatic approach and mobilizing all types of investments to expedite the implementation of NDCs, National Adaptation Plans (NAPs), and Long-term Strategies (LTS) was highlighted. It was stressed that climate finance is available but not always accessible at the speed and scale required, and the framework aims to address this by evolving through ongoing consultation and input from various stakeholders.

Collectively, the speakers agreed on the necessity of innovative climate finance mechanisms, strategic partnerships, and the need for reform in the global financial architecture. They complemented each other by providing different perspectives and examples of successful initiatives, highlighting the importance of collaborative efforts to mobilize the necessary resources for climate action. Moving forward, the Road to COP29 Series will continue to explore these themes, aiming to drive meaningful progress in innovative climate finance and the reform of global financial structures to support sustainable development and climate resilience.

We thank our esteemed guests for their invaluable insight and contributions to the engaging discussion and participation of all the guests and attendees. We look forward to future opportunities to advance this important agenda further through the upcoming events taking place as part of our ‘Road to COP29’ event series.

read more